You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to List

Due to the ongoing situation with Covid-19, we are offering 3 months free on the agent monthly membership with coupon code: COVID-19A

UNLIMITED ACCESS

With an RE Technology membership you'll be able to view as many articles as you like, from any device that has a valid web browser.

Purchase AccountNOT INTERESTED?

RE Technology lets you freely read 5 pieces of content a Month. If you don't want to purchase an account then you'll be able to read new content again once next month rolls around. In the meantime feel free to continue looking around at what type of content we do publish, you'll be able sign up at any time if you later decide you want to be a member.

Browse the siteARE YOU ALREADY A MEMBER?

Sign into your accountProduct Review: MileIQ Is a Hassle-free Way to Track Your Mileage Deductions

September 14 2016

Real estate agents drive an estimated 30,000 miles per year, according to the National Association of Realtors. That adds up to a lot of expenses in gas, maintenance, and insurance. Fortunately, IRS rules allow you to deduct those business related expenses at a rate of 54 cents per mile--or over $16,000 a year for the average agent!

Real estate agents drive an estimated 30,000 miles per year, according to the National Association of Realtors. That adds up to a lot of expenses in gas, maintenance, and insurance. Fortunately, IRS rules allow you to deduct those business related expenses at a rate of 54 cents per mile--or over $16,000 a year for the average agent!

While a deduction of that size makes a huge difference in your annual tax bill, the IRS requires that you keep a detailed record of business related drives in order to qualify for the deduction.

That's where MileIQ comes in. MileIQ is a mobile app that automatically logs all of your drives and keeps track of your potential mileage deductions. Now agents can say goodbye to the old pen-and-paper log and lean on their GPS-enabled smartphone to keep scrupulous records for them.

How It Works

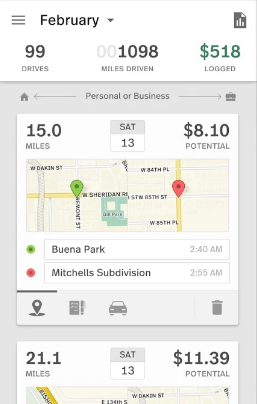

MileIQ taps into your phone's location services capabilities--including GPS, Wi-Fi, and cell tower triangulation--to automatically track all of your drives. After a drive is completed, the app prompts you to classify the drive as either personal or business. This is done with a single gesture: swipe right to classify as business; swipe left to classify the drive as personal.

As you can see in the image above, the app will display the route of your drive on a map, start and end times, length of trip, and the potential dollar amount of the deduction. In addition to classifying your drive, you can optionally add notes (including parking and toll fees), select which car you drove, or delete the drive altogether.